For many California homeowners, a "cost plus" contract sounds like a transparent and fair way to pay for a home renovation. The idea seems simple: you pay the contractor for their direct costs (materials, labor, subcontractors) plus a pre-agreed percentage or fixed fee for their overhead and profit.

However, if you're planning a home improvement project in California, be warned: most cost plus contracts for residential projects are illegal under state law. This isn't just a minor technicality; it can render your contract unenforceable, lead to disputes, and expose both you and your contractor to significant legal headaches.

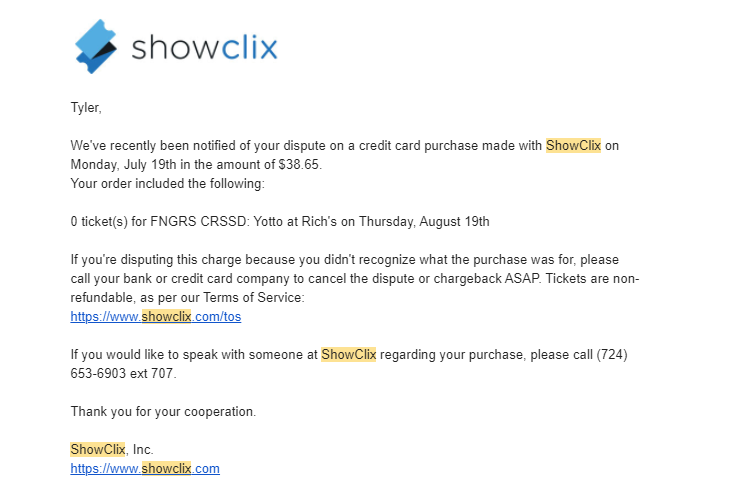

The Law is Clear: California Business & Professions Code § 7159

The legality of home improvement contracts in California is governed by the Business and Professions Code (B&P Code), specifically § 7159. This code section outlines stringent requirements for contracts over $500, designed to protect homeowners from fraud and unscrupulous practices.

One of the most critical requirements is the need for a fixed contract price.

California B&P Code § 7159(d)(5) states:

"The contract shall contain the approximate date when the work will begin and the approximate date of satisfactory completion. The contract shall also contain a plan and scale or description of the project and description of the material to be used and equipment to be installed, and the agreed consideration for the work."

The key phrase here is "agreed consideration for the work." In plain language, this means the contract must clearly state the total price the homeowner will pay for the entire project upfront.

Why "Cost Plus" Fails This Test

A true "cost plus" contract, by its very nature, does not have a fixed, agreed-upon total price at the time of signing. The final price fluctuates based on the actual costs incurred, which are unknown when the contract is executed. This directly violates the requirement for an "agreed consideration" or a fixed total price.

What Types of Projects Are Affected?

This prohibition primarily applies to home improvement contracts between a licensed contractor and an owner or tenant for residential property. This includes:

Remodels

Additions

Kitchen and bathroom renovations

Landscaping (if part of a larger home improvement)

Deck construction

Roofing

HVAC installation

Important Exceptions (Where Cost Plus Might Be Legal):

Commercial Projects: B&P Code § 7159 does not apply to commercial construction.

New Home Construction: Building a brand-new home (from the ground up) is generally not considered a "home improvement" under this specific code section.

Projects Under $500: Very small projects (though few contractors would use a formal contract for these).

Time & Materials (T&M) for Service & Repair: For emergency repairs or service calls where the total price cannot be reasonably determined beforehand, T&M contracts can be legal, but they have their own specific requirements under B&P Code § 7159.4. They are distinct from the open-ended "cost plus" often used in larger renovation projects.

The Risks of an Illegal Cost Plus Contract

For homeowners, entering into an illegal cost plus contract carries several significant risks:

Unforeseen Costs: The most obvious risk is that the final bill can balloon far beyond initial estimates, with little recourse.

Contract is Potentially Unenforceable: If a dispute arises, a court may deem the entire contract illegal and unenforceable, creating ambiguity for both parties.

No Protection from Mechanics Liens: Even with an illegal contract, an unpaid contractor can still file a mechanics lien against your property, forcing you into legal action to resolve the issue.

Licensing Board Issues: Contractors who use illegal contracts can face disciplinary action from the Contractors State License Board (CSLB), including fines and license suspension.

What California Home Improvement Contracts Must Include

To protect yourself, always ensure your home improvement contract contains the following, as required by B&P Code § 7159:

Fixed Total Price: A clear, lump-sum amount for the entire project.

Start and Completion Dates: Approximate dates for when work will begin and be substantially completed.

Detailed Description of Work: Plans, specifications, materials to be used, and equipment to be installed.

Payment Schedule: Clearly defined payments tied to specific milestones, not just "costs incurred."

Notice of Right to Cancel: Homeowners generally have a three-day right to cancel.

Contractor's License Number: Must be clearly displayed.

Lien Warnings: Information about mechanics liens.

Arbitration Clause (if applicable): Must be a separate, clearly marked provision.

Protecting Your Home Improvement Investment

Don't let the allure of "transparency" lead you into an illegal contract. Always insist on a fixed-price contract for your California home improvement project. If a contractor proposes a pure "cost plus" arrangement for a residential remodel, it's a major red flag, and you should seek legal advice or find another contractor.

Need help reviewing a home improvement contract or dealing with a dispute?